Yet another fiscal rift is emerging between the Shumlin administration and the Legislature.

The administration is asking the Legislature to allocate $18.4 million annually to operate and maintain the state’s new health insurance marketplace — the web-based exchange called Vermont Health Connect [2]. But before the House Ways and Means Committee determines how to raise that new sum on a yearly basis, legislators want to verify that the administration has done its due diligence.

“My biggest problem is that I just don’t know how to judge what’s a reasonable cost given what we need to do,” said Rep. Martha Heath, chair of the House Appropriations Committee. “That’s why we’re asking outside consultants to take a look at it.”

The Legislature’s Joint Fiscal Office is working with Health Management Associates to conduct an independent evaluation of what the exchange would cost the state to run, and that analysis is due at the end of this month. While the state is bringing in more than $100 million [3] in federal assistance to set up the exchange, Vermont will be left with the cost of managing the marketplace once it’s going.

The administration’s proposal

Mark Larson, commissioner of the Department of Vermont Health Access, told the House Appropriations Committee last week that he didn’t think the state could run the new marketplace for less.

“I don’t … have a great optimism I could bring to you a $12 million exchange instead of an $18 million exchange,” he said. “When you look at this compared to other states we are at the low end.”

Larson provided VTDigger with cost figures he gathered from conversations with those in some of the 17 other states that are setting up the exchange, as well as Washington, D.C.

According to his chart:

• Vermont, Nevada and New Mexico will operate exchanges at an annual cost of $15 million-$20 million a year.

• Connecticut, Rhode Island, Colorado and Washington, D.C., will spend roughly $25 million a year.

• Massachusetts, Washington, Minnesota, Kentucky and Oregon will spend between $35 million and $60 million a year.

• California and New York will spend between $100 million and $300 million annually.

Larson did concede, however, that Vermont’s per member cost to operate a state-run exchange — for about 110,000 residents at the outset — is on target to be the highest in the country.

“It will always be true that on a per-member per-month cost we will be higher because, at some point, opening an exchange for one person costs a certain amount, and we only have so many people who can sign up,” he told House Appropriations. “We will always look high on a per-member count.”

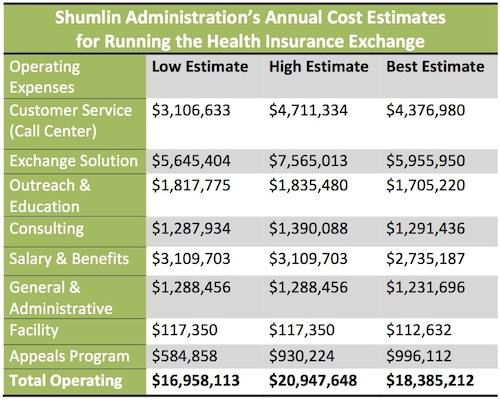

Larson and the administration worked with the auditing firm KPMG to draw up the projected $18.4 million cost of running the state’s exchange. KPMG estimated that it would cost as little as $17 million and as much as $21 million annually. The $18.4 million is the administration’s best estimate, Larson said.

The bulk of that cost consists of a $4.4 million call center to assist Vermonters who are purchasing plans and $6 million in information technology components, such as processing premiums, integrating the exchange with other databases, and hosting the web portal.

The other $8 million comes from outreach, consulting and administration fees (for a full list of the estimated costs, see the chart below). The $2.7 million in salaries and benefits would go to paying 29 state positions that would operate the exchange, including financial analysts, program directors, outreach representatives, a grant writer and other positions. When the exchange first comes on line at the beginning of 2014, the administration wants to employee 69 individuals to get the exchange up and running. After a year, Larson said the state would begin ramping down the number to 29 employees.[4]

To raise the lion’s share of the $18.4 million, the administration has proposed levying a 1 percent increase on health insurance for total claims in a fiscal year. This increase would raise roughly $17 million annually, Larson said.

Health insurers say this tax hike would raise health insurance rates for Vermonters.

Acting fast or not at all?

In a letter to legislative leaders, Secretary of Administration Jeb Spaulding stressed the need for the Legislature to act promptly on a financing plan for the exchange.

“To stay in compliance with the Affordable Care Act and CMS [Centers for Medicare and Medicaid Services] requirements, the state must pass a financing plan this session,” he said. “Failure to do so puts the success of Vermont’s exchange at risk.”

But legislators are moving prudently.

“It costs a lot of money,” said Rep. Dave Sharpe, D-Bristol, who sits on the House Ways and Means Committee. “I think we’re a little cautious about it because the state has been burned on some IT projects in the past, and so I think there is concern that we do this right and as inexpensively as we can … not to waste taxpayer dollars.”

Rep. Carolyn Branagan, R-Georgia, vice chair of House Ways and Means, said she was under the impression that a state-run exchange was going to cost the state less money.

“It bothers me a great deal that the state will just simply pick up these costs,” she said. “In the beginning, we were told that there was money being used out in health care that would be recouped and used in this new plan, and now we’re finding this is not the case at all.”

Branagan also told VTDigger that using the federal exchange rather than a state-run exchange would be a safer option with less financial risk. During Larson’s testimony in front of House Appropriations, several lawmakers questioned the way that the administration has interpreted the federal Affordable Care Act.

“It’s too late in the game to switch paths,” Larson countered. “To change courses at this point would be really, really upsetting for a number of policy reasons, the ability to maintain mandates we enjoy in Vermont, the ability to control our plan design, the ability to control our consumer assistance — all of which we would lose in the federal exchange.”